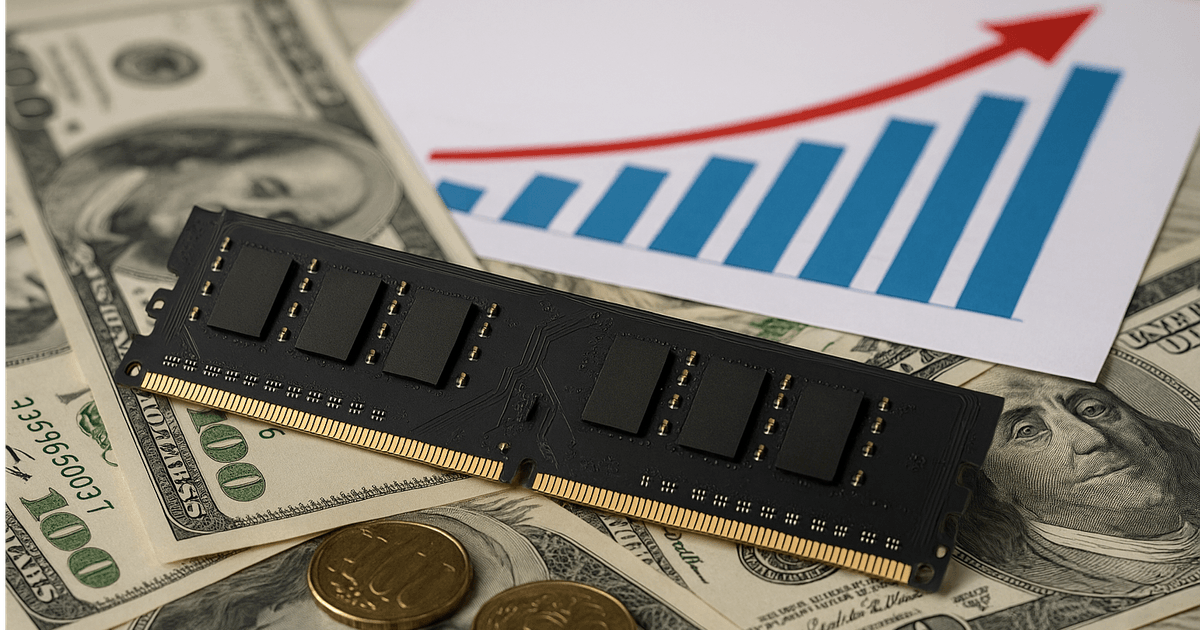

Just months after the noticeable surge in DDR4 prices, the PC industry is facing another wave — this time with DDR5. Once expected to stabilize as production matured, DDR5 memory is now climbing sharply in cost. From high-end desktop kits to mainstream 16 GB modules, prices have risen as much as 30–50% in certain regions. What’s driving this new round of increases — and how might it affect PC builders, system integrators, and component brands?

The Current Market Situation

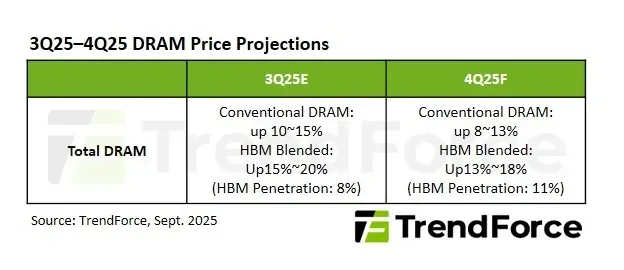

(image credit :TrendForce)

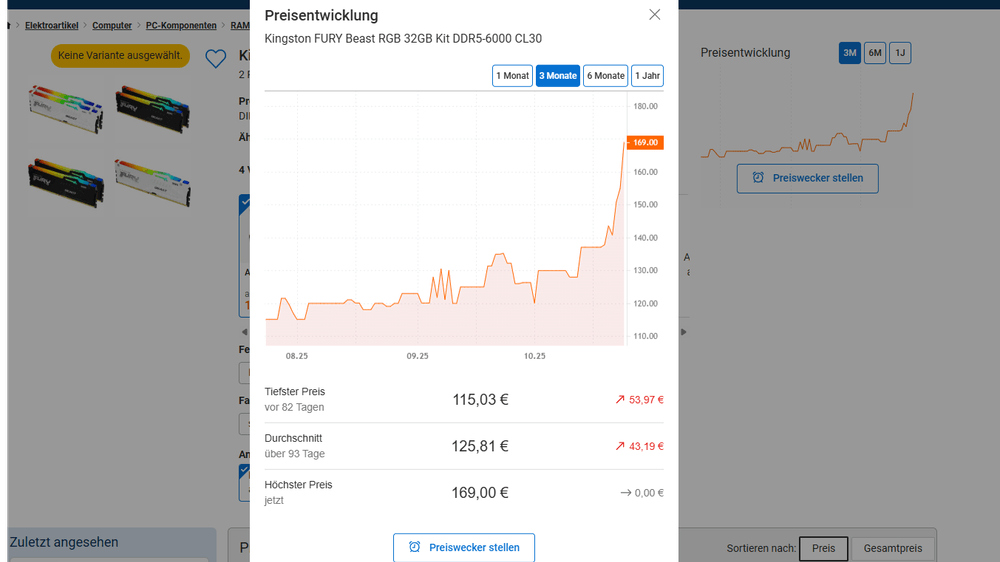

According to TrendForce, DRAM spot prices surged nearly 10% in a single week this October as buyers rushed to secure inventory ahead of further hikes. DDR5 modules — which once benefited from falling prices as adoption spread — are now trending upward in both spot and contract markets.

Notebookcheck reports that community data shows retail DDR5 kits from brands like Corsair, G.Skill, and Kingston rising significantly in Europe and Asia. In some regions, the price per gigabyte has nearly doubled compared to mid-year 2024 levels.

For consumers, this means one clear thing: upgrading or building a DDR5-based system is getting more expensive again.

What’s Causing the Surge

The reasons behind the DDR5 price rise are complex, but a few major factors stand out:

1. AI and Data Center Demand

Global AI infrastructure build-outs are consuming vast amounts of memory. Data centers deploying GPUs like NVIDIA’s H100 and H200 rely on high-bandwidth DRAM (HBM) and advanced DDR5 chips, directly competing with consumer-grade production capacity.

As Tom’s Hardware recently noted, “AI data centers are swallowing the world’s memory supply.” This diversion of wafer allocation from PC DRAM to HBM has reduced output for DDR5 modules used in consumer and enterprise PCs.

2. Manufacturers Prioritizing High-Margin Products

Major DRAM suppliers — Samsung, SK Hynix, and Micron — have strategically shifted focus toward more profitable segments like HBM3E and LPDDR5X. Commodity DDR5 modules yield lower profit per wafer, so manufacturers are scaling back consumer DRAM lines to optimize margins.

3. Panic Buying and Inventory Hedging

When rumors of supply shortages surface, memory module assemblers and distributors often buy ahead to lock in pricing. This behavior, while rational, amplifies short-term demand and constrains supply in the spot market, leading to sudden price spikes — the same pattern we saw during DDR4’s recent rebound.

4. Supply Chain Transition and Yield Issues

As fabs migrate to 1β and 1α nm nodes for next-gen DRAM production, yields can initially drop. That limits supply while costs remain high. Combined with continued geopolitical uncertainties and logistics challenges, memory output simply isn’t keeping up with demand.

Impact on PC Builders

(Image Credit: idealo)

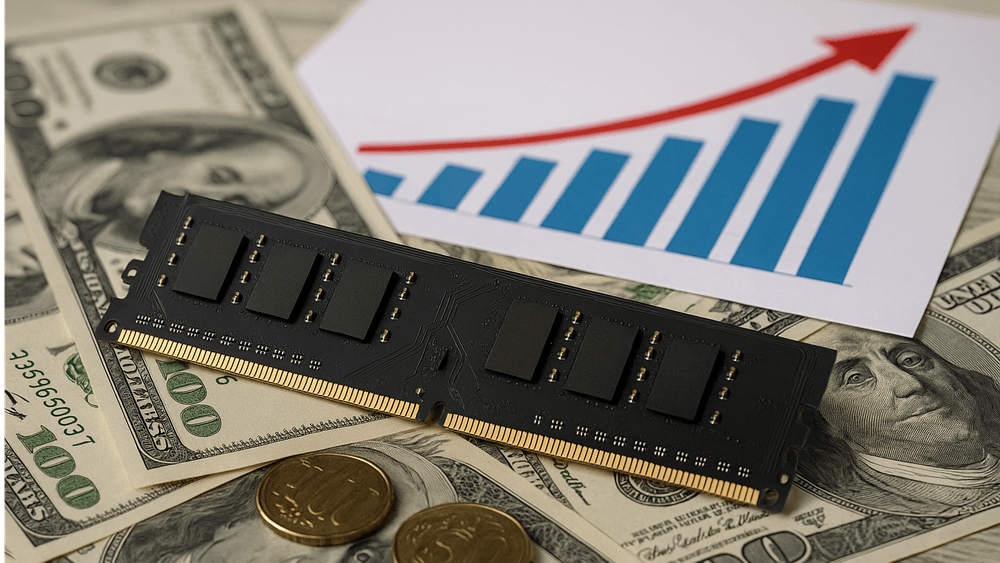

For PC builders and DIY enthusiasts, higher DDR5 prices increase total build cost — especially in mid-range and performance segments.

A memory kit that cost $80–90 earlier this year may now exceed $120–130. While that might seem minor for premium builds, it directly affects the bill of materials (BOM) for integrators and system assemblers.

Market Outlook

Analysts expect the DRAM price uptrend to continue into early 2026, driven by AI hardware demand and restrained production volumes. TrendForce predicts overall DRAM prices could rise 10–20% quarter-over-quarter, depending on market response.

The silver lining is that DDR5 remains in high demand thanks to platform adoption (Intel 700-series, AMD AM5). As more users transition, economies of scale could eventually bring stability — but not before this current shortage cycle plays out.

What Builders and Buyers Should Do

Secure modules early: If you’re planning new PC builds or system batches, lock in DDR5 inventory before the next quarter’s pricing revision.

Offer flexible configurations: For OEMs or boutique builders, consider offering both DDR4 and DDR5 SKUs where platform compatibility allows.

Monitor supplier communication: Stay updated with module vendors on lead times and allocation changes.

Communicate value: Even as costs rise, focus marketing on overall system performance, stability, and forward-compatibility, not just raw specs.

Conclusion

DDR5’s price surge highlights the new reality of a memory market dominated by AI and data-center demand. As production capacity shifts toward high-bandwidth applications, consumer DRAM will continue to feel the squeeze. For PC enthusiasts and brands alike, this isn’t just a supply-chain story — it’s a reminder that even as technology evolves, the economics of silicon remain as volatile as ever.